Introduction

Cryptocurrency trading has become a global phenomenon, attracting both beginners and experienced traders seeking to capitalize on the volatility of digital assets. Cryptocurrency exchange , Crypto trading platform , Bitcoin exchange , Altcoin exchange A cryptocurrency exchange serves as the marketplace where users buy, sell, and trade various digital currencies like Bitcoin (BTC), Ethereum (ETH), and numerous altcoins. This article provides an in-depth look at the best crypto exchanges, their features, and how to trade cryptocurrencies effectively and securely.

# Cryptocurrency exchange # Crypto trading platform # Bitcoin exchange # Altcoin exchange

Buy and Sell Cryptocurrency

Cryptocurrency exchanges enable users to buy and sell digital assets in a seamless manner. Cryptocurrency exchange , Crypto trading platform , Bitcoin exchange , Altcoin exchange Depending on the type of exchange, users can conduct transactions using fiat currencies (e.g., USD, EUR) or other cryptocurrencies. Here are the primary methods for buying and selling cryptocurrencies:

Centralized Exchanges (CEXs): Platforms such as Binance, Coinbase, and Kraken provide user-friendly interfaces and liquidity, making it easier to trade crypto.

Decentralized Exchanges (DEXs): Platforms like Uniswap and PancakeSwap allow peer-to-peer transactions without intermediaries, offering increased security and anonymity.

Peer-to-Peer (P2P) Trading: Services like LocalBitcoins enable users to trade directly with one another using customizable payment methods.

Best Crypto Exchange

Choosing the best crypto exchange depends on factors like security, fees, supported assets, and user experience. Some of the top exchanges in the industry include:

Binance: Offers high liquidity, low trading fees, and advanced trading tools.

Coinbase: Ideal for beginners, providing an intuitive interface and strong regulatory compliance.

Kraken: Known for its robust security features and futures trading.

KuCoin: Offers a wide range of altcoins and passive income options like staking.

FTX: Specializes in derivatives and leveraged trading (currently in transition due to regulatory concerns).

Digital Currency Exchange

A digital currency exchange acts as an intermediary, facilitating the conversion between cryptocurrencies and fiat money. Key features of these exchanges include:

Liquidity Pools: Ensuring smooth trading experiences and minimizing slippage.

Trading Pairs: Allowing users to trade crypto assets against fiat or other cryptocurrencies (e.g., BTC/ETH, USDT/BTC).

Market Orders and Limit Orders: Giving traders flexibility in executing transactions.

Security Measures: Implementing features like multi-signature wallets, two-factor authentication (2FA), and cold storage.

Ethereum Trading

Ethereum (ETH) is the second-largest cryptocurrency by market capitalization and is widely traded across various platforms. To effectively trade Ethereum, consider:

Ethereum Trading Strategies: Day trading, swing trading, and long-term holding.

Ethereum Pairings: ETH/USD, ETH/BTC, ETH/USDT, among others.

Ethereum 2.0 Staking: Users can earn rewards by participating in Ethereum’s proof-of-stake (PoS) network.

Crypto Market Overview

The crypto market is highly volatile, influenced by factors such as market sentiment, regulations, and technological developments. Major aspects of the market include:

Market Cap: Bitcoin and Ethereum dominate the space, followed by a growing number of altcoins.

Bull vs. Bear Markets: Prices fluctuate dramatically, affecting investment strategies.

Tokenomics: Supply mechanisms, staking rewards, and burning mechanisms impact coin valuations.

Secure Crypto Exchange

Security is a top priority when choosing a secure crypto exchange. Essential security features include:

Cold Storage: Keeping assets offline to prevent hacks.

KYC and AML Compliance: Ensuring regulatory adherence and fraud prevention.

Two-Factor Authentication (2FA): Adding an extra layer of protection to user accounts.

Insurance Funds: Some exchanges offer protection against hacks or financial losses.

Crypto Wallet Solutions

A crypto wallet is essential for storing digital assets securely. Wallet types include:

Hot Wallets: Online wallets like MetaMask and Trust Wallet provide quick access but are vulnerable to hacks.

Cold Wallets: Hardware wallets like Ledger and Trezor offer enhanced security by keeping assets offline.

Multi-Signature Wallets: Used for added security in institutional trading and business transactions.

# Cryptocurrency exchange # Crypto trading platform # Bitcoin exchange # Altcoin exchange

Trade Bitcoin and Ethereum

Bitcoin (BTC) and Ethereum (ETH) are the most widely traded cryptocurrencies. Traders should:

Use Technical Analysis (TA): Charts, indicators, and patterns help predict price movements.

Monitor News and Regulations: Market shifts often follow regulatory updates.

Diversify Investments: Avoid putting all funds into one asset to manage risk.

Cryptocurrency Trading Services

Leading exchanges offer a variety of cryptocurrency trading services, including:

Spot Trading: Buying and selling assets at current market prices.

Margin Trading: Borrowing funds to increase leverage.

Futures & Options: Speculating on future price movements.

Staking & Yield Farming: Earning passive income from crypto holdings.

Best Cryptocurrency for Trading

Some of the most traded and profitable cryptocurrencies include:

Bitcoin (BTC): The market leader with high liquidity.

Ethereum (ETH): Strong ecosystem with DeFi and NFTs.

Solana (SOL): Fast transactions with low fees.

Binance Coin (BNB): Utility token for Binance ecosystem.

Cardano (ADA): Focused on scalability and sustainability.

Exchanges for Crypto Traders

Different types of traders require specific features:

Beginner Traders: Coinbase, Kraken.

Advanced Traders: Binance, Bybit, FTX (before regulatory issues).

DeFi Traders: Uniswap, SushiSwap.

Crypto Exchange Reviews

Reviews and user feedback help traders choose the right platform. Key criteria include:

Trading Fees: Low-cost platforms attract more traders.

Customer Support: Reliable support enhances user experience.

Asset Selection: A broad range of coins benefits portfolio diversification.

Blockchain Trading Platform

A blockchain trading platform utilizes decentralized ledgers to facilitate transactions. Advantages include:

Transparency: Public ledger ensures full transaction visibility.

Immutability: Transactions cannot be altered once confirmed.

Decentralization: Eliminates middlemen and enhances security.

Decentralized Exchange (DEX)

A decentralized exchange (DEX) operates without intermediaries. Key features include:

Automated Market Makers (AMMs): Smart contracts facilitate trades.

Liquidity Pools: Users provide funds for swaps.

Greater Privacy: No need for KYC verification.

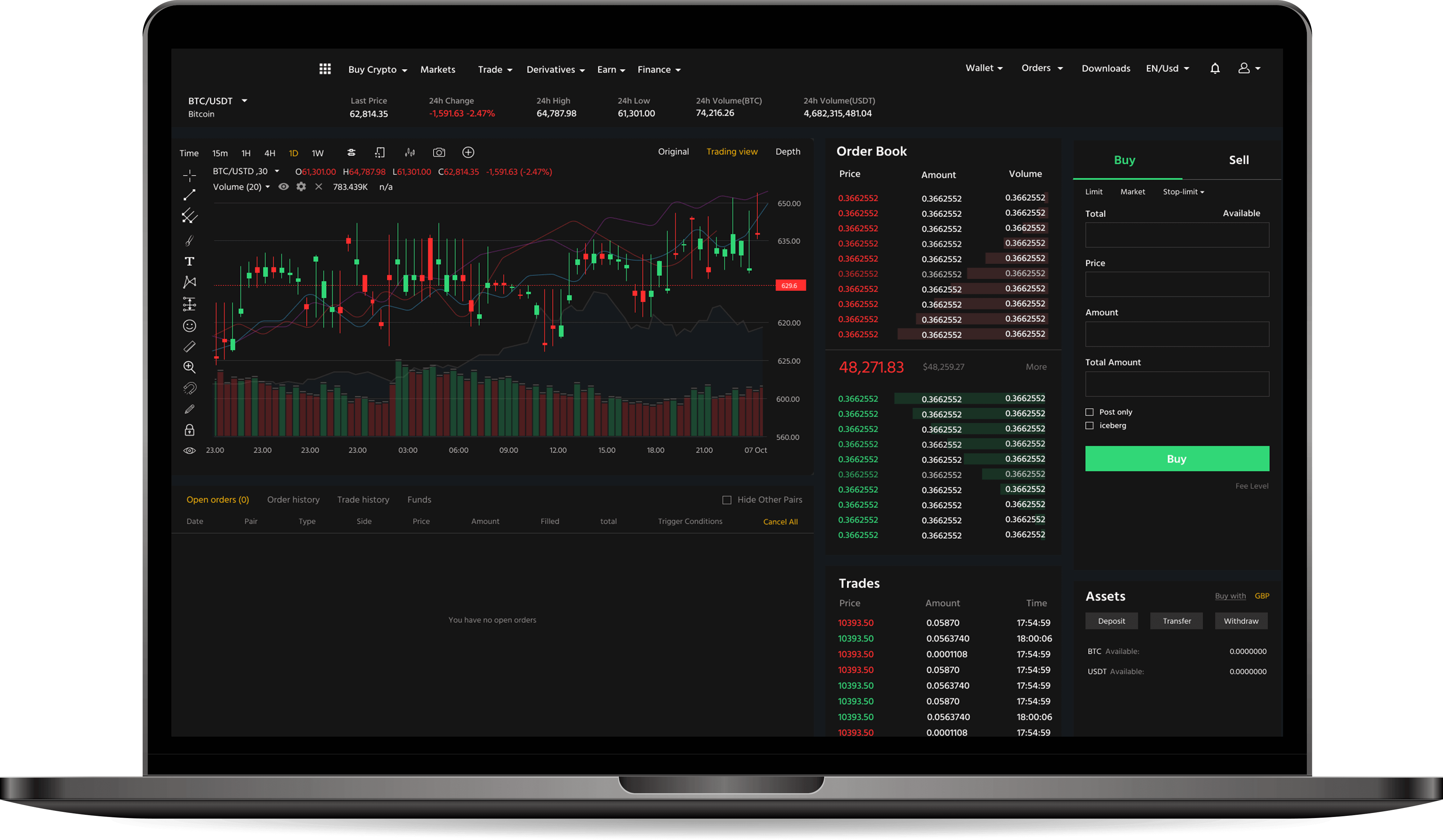

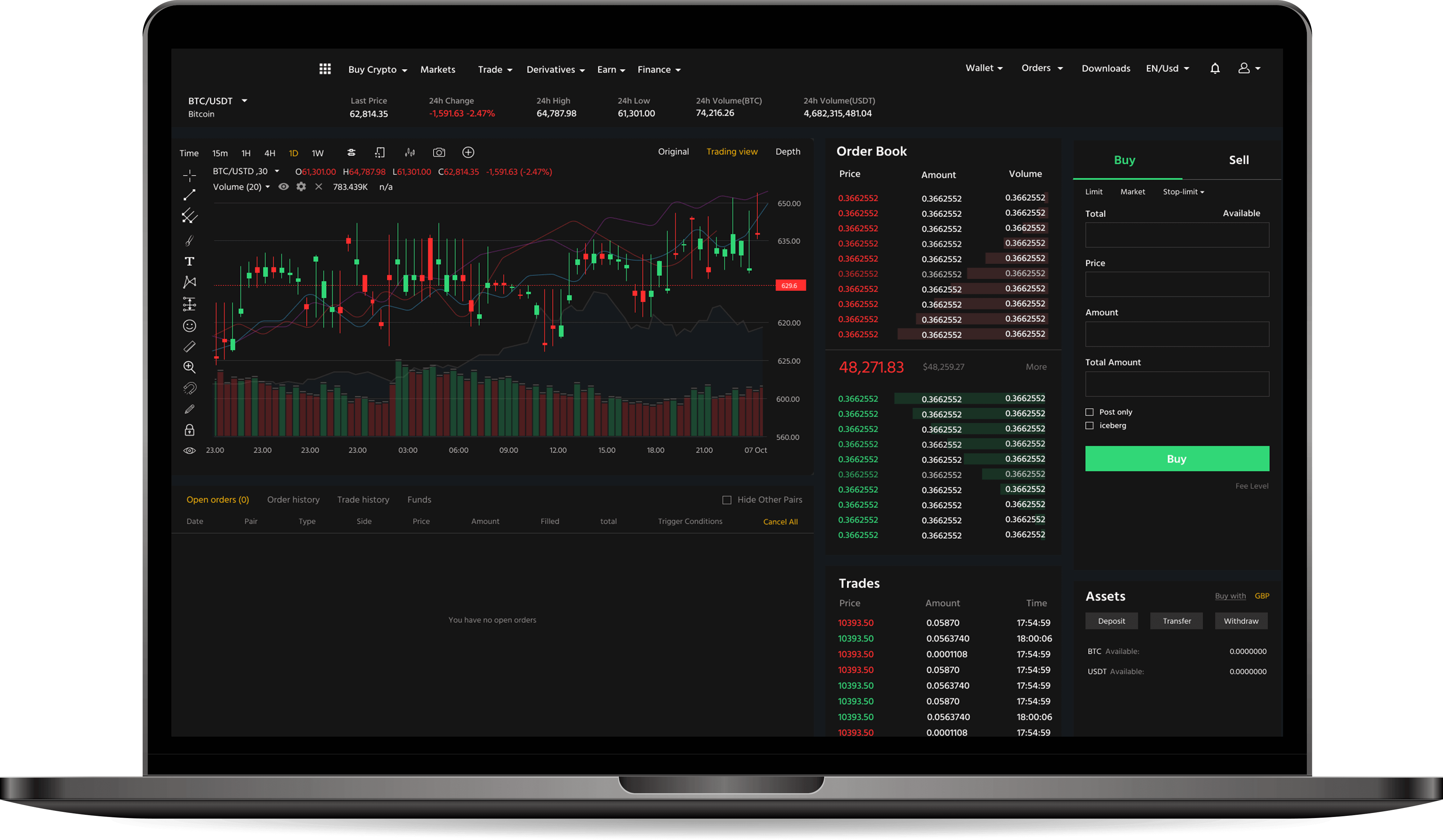

Crypto Trading Platform Features

A good crypto trading platform should offer:

User-friendly Interface: Easy navigation for all traders.

Advanced Trading Tools: Charting, stop-loss, and margin trading.

High Liquidity: Ensures smooth order execution.

Mobile Compatibility: Trading on the go via mobile apps.

How to Trade Cryptocurrency

Trading cryptocurrencies successfully involves:

Choosing a Reliable Exchange: Ensure security and liquidity.

Understanding Market Trends: Use fundamental and technical analysis.

Implementing Risk Management: Set stop-loss orders to minimize losses.

Practicing on Demo Accounts: Test strategies without real money risks.

Cryptocurrency exchanges serve as the backbone of the digital asset ecosystem, enabling users to buy, sell, and trade cryptocurrencies. Understanding the different types of exchanges, trading strategies, and security measures will help traders navigate the dynamic crypto market efficiently. By selecting the right platform and implementing sound trading practices, users can optimize their investment strategies and maximize potential gains in the ever-evolving world of cryptocurrency trading.

Website source: www.exbix.com

Creating unique content and building backlinks

Max online digital marketing agency

:: بازدید از این مطلب : 50

|

امتیاز مطلب : 0

|

تعداد امتیازدهندگان : 0

|

مجموع امتیاز : 0